do you pay taxes on inheritance in north carolina

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. The answer is probably not.

187 Front Page 1 30 Normalize North Carolina Court System

There is no inheritance tax in NC.

. With the property tax your federal tax would be 187 million. State rules usually include thresholds of value. There is no inheritance tax in North Carolina.

Where to go for more help with inheritance income. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. North Carolina does not collect an inheritance tax or an estate tax.

No estate tax or inheritance tax North carolina does not collect an inheritance tax or an estate tax. How Do Inherited Property Taxes Work. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million.

However the federal government still collects these taxes and you must pay them if you are liable. There is no inheritance tax in North Carolina. In some states the executor may be required to obtain an inheritance tax waiver from the state tax authorities before the assets in the deceaseds.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Beneficiaries can only do so much to avoid inheritance taxes once theyve inherited. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state.

Generally speaking inheritances are not income for federal tax purposes. Home Sale Tax Exclusion. Do you have to pay taxes on inheritance in north carolinaPay valid debts and taxes and.

An inheritance of 382 million falls into the highest tax rate so youll have to pay 40. However there are a few states that impose taxes on them so it is important to know what your tax responsibilities are. Estate taxes generally apply only to wealthy estates while.

However - there is no inheritance taxes on neither federal nor state level in North Carolina. These are some of the taxes you may have to think about as an heir. However there are sometimes taxes for other reasons.

Inheritance tax is a. The home sale tax exclusion is one of the more generous tax exclusion rules. The goods news is that there is no federal inheritance tax which means you wont have to pay taxes on a property simply for inheriting it.

Do You Have to Pay Taxes on Inheritance. If you live in a state that does have an estate tax you may be expected to pay the death tax on the money you inherit from a death in NC. Even though gifting the home isnt a good way to dodge the taxes there are some legal tax exclusions that you might find helpful.

These include capital gains retirement account income tax and other similar taxes. Some states have a state inheritance tax but luckily North Carolina is not one of these states. When you are receiving an inheritance you may wonder if you are required to pay a tax on the inheritance.

When you are receiving an inheritance you may wonder if you are required to pay a tax on the inheritance. When a loved one or benefactor dies and leaves property or money to you you might have to pay inheritance and estate taxes on it. Inheritance tax is imposed on inheritance passed to beneficiaries.

This exclusion lets you avoid paying taxes on the gains from a home sale up to 250000 or 500000 if two people file jointly. Inheritance tax is different from estate tax and whether you pay might come down to the state you live in. Inheritances that fall below these exemption amounts arent subject to the tax.

However - there is no inheritance taxes on neither federal nor state level in North Carolina. Court fees include the filing fees to create the estate 120 and the probate fee that is taxed against the personal property assets of the estate 04 of the value of the personal property assets in the estate with a minimum fee of 15 and a maximum fee of 6000. While you probably dont have to pay inheritance or estate tax other taxes may apply.

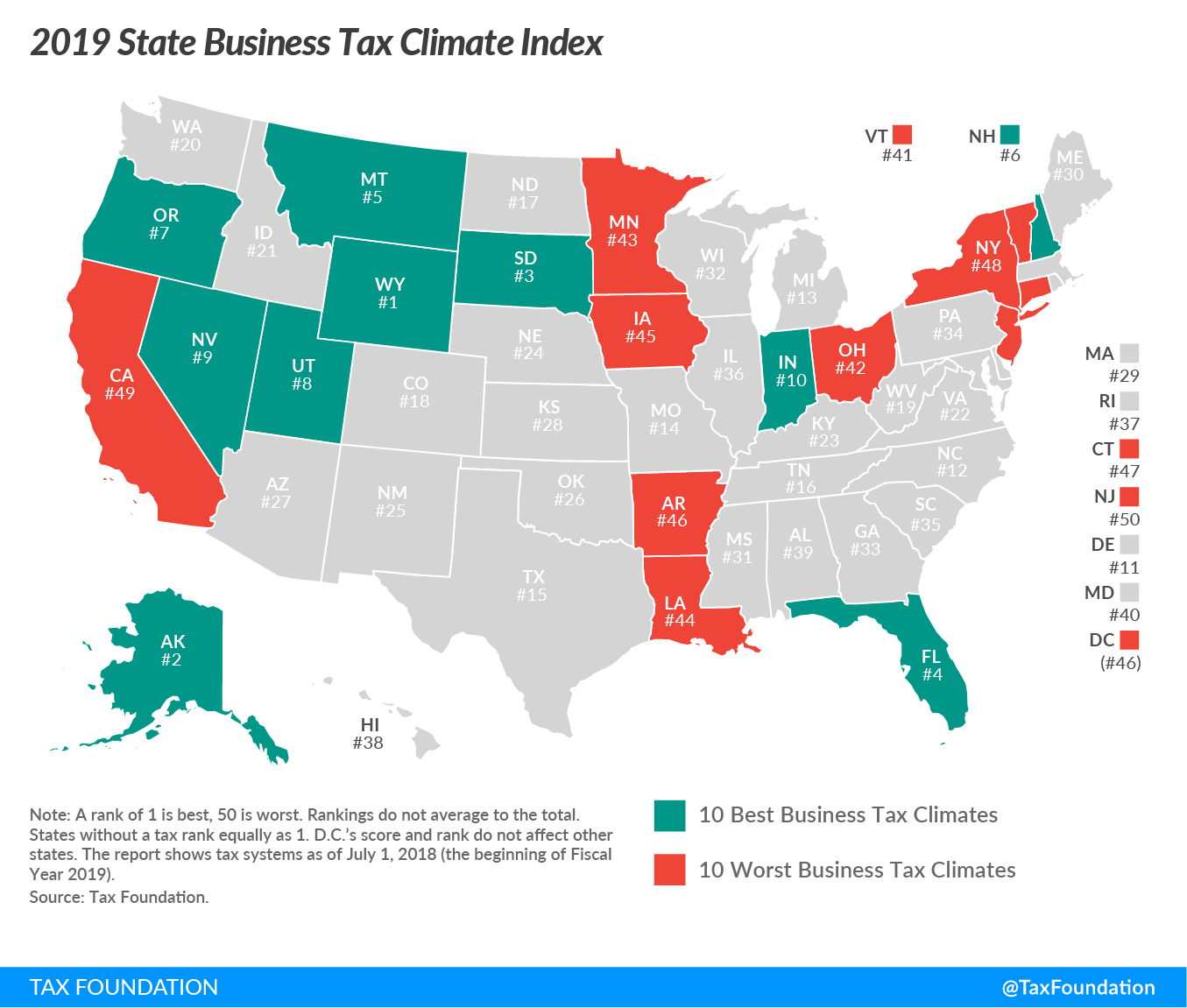

That is 152 million. The tax bill for the average Tarheel is just 8739 putting it among the most tax-friendly states in the countryWhen you consider that almost 5000 of that is federal income taxes its not hard to see that North Carolina is one state that has eased the burden of state and local taxes on its residents. The state income tax rate is 525 and the sales tax rate is 475.

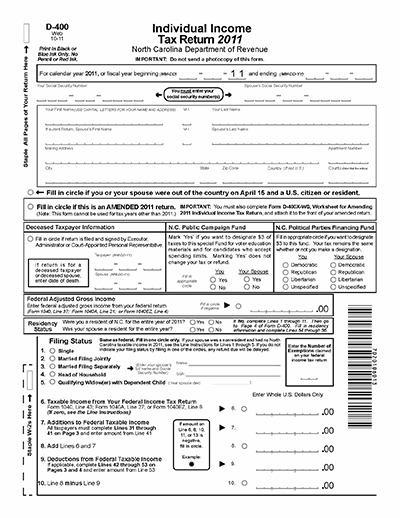

The recipient of an inheritance is not going to be paying transfer taxes on the inheritance unless there is an inheritance tax in the state within which the recipient resides. Welcome to JustAnswer There are several tax types involved - income taxes estate taxes and inheritance taxes - and two levels of taxation - federal and state. North Carolina offers tax deductions and credits to reduce your tax liability including a.

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. Mostly inherited property taxes come from the sale of the property. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state.

However there are 2 important exceptions to this rule. There is no gift tax in North Carolina. North Carolina Inheritance Tax and Gift Tax.

South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state.

North Carolina State Taxes 2022 Tax Season Forbes Advisor

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

John Spencer Bassett 1867 1928 Slavery In The State Of North Carolina

What North Carolina Residents Need To Know About Federal Capital Gains Taxes

North Carolina Taxes Guidebook To 2020 Guidebook To North Carolina Taxes William W Nelson J D 9780808053101 Amazon Com Books

North Carolina Health Legal And End Of Life Resources Everplans

How Can I Mitigate My Children Paying Taxes On My Estate In Raleigh When I M Gone

North Carolina Estate Tax Everything You Need To Know Smartasset

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Us Legal Forms

North Carolina State Taxes Everything You Need To Know Gobankingrates

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina Estate Tax Everything You Need To Know Smartasset

Historical North Carolina Tax Policy Information Ballotpedia